For borrowers with undesirable credit rating, mounted fascination premiums can be more favorable as they supply certainty and make budgeting less complicated. Variable curiosity charges, although They might to begin with offer you decreased costs, could become unpredictable and perhaps enhance expenditures after some time.

Work history: Lenders typically like borrowers using a steady employment historical past. Ordinarily, They could call for borrowers to have been employed for a specific period, such as 6 months or lengthier.

Have an understanding of your credit circumstance: Familiarize on your own with your credit history report and rating. Determine any mistakes or discrepancies and deal with them With all the credit rating bureaus. Figuring out your credit history weaknesses and spots for advancement can help you current a more convincing scenario to your lender.

As their spouse and children has struggled in the pandemic, Charlie and his lover have already been supporting their developed kids financially, and are now struggling to pay finishes fulfill them selves.

Be realistic and flexible: Recognize that with terrible credit rating, you may not give you the option to negotiate probably the most favorable terms.

Highlight your strengths: Though your credit score may very well be weakened, target emphasizing your optimistic aspects to your lender. Highlight steady work, constant income, and any collateral or property you have that can provide protection for the loan.

The debt-to-credit more info rating ratio is the percentage of the amount a borrower owes when compared with their credit limit and it has an influence on their credit score rating; the higher the percentage, the lessen the credit score.

We have now calculated this dependant on publicly out there information and facts through the lender and your search phrases. The loan prices may perhaps range dependant upon the loan volume, loan period, your credit rating record, together with other variables.

Any time you take out a loan, you need to shell out back the loan furthermore interest by creating typical payments towards the financial institution. So you're able to visualize a loan being an annuity you fork out to your lending institution.

Strengthen your enterprise with rewards, perks and a lot more. Look at playing cards in a single destination to locate the a person for you.

Come up with a demanding budget. The more investing you'll be able to Minimize back again on, the extra money it is possible to place toward paying out off your own loan and getting to be financial debt-cost-free. It's also possible to start off constructing an unexpected emergency fund to assist decrease the probabilities that you’ll need to consider out more loans Down the road.

The loan variety you select affects your monthly home finance loan payment. Explore mortgage loan selections to suit your paying for state of affairs and get monetary savings.

Use Zillow’s property loan calculator to immediately estimate your whole property finance loan payment which includes principal and fascination, moreover estimates for PMI, home taxes, property insurance and HOA costs.

You can obtain a personal loan from on the internet lenders, credit unions, and banks. If you're purchasing for a private loan, here's A fast have a look at your options for vendors:

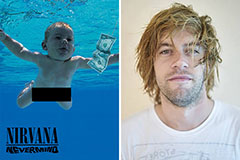

Spencer Elden Then & Now!

Spencer Elden Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!